Reach Your Homeownership Goals

Stop Daydreaming About a New Home Get Pre-Qualified NOW! Mortgage Trends Whether you’re a first-time or move-up home buyer, don’t postpone a purchase if your area’s affected by climbing home prices. Over the past few years, house buyers in much of the country have increased. For seven months, home prices declined, and although recently, the prices […]

Being Self-Employed Just Got Easier

A Valuable Loan Option for Being Self-Employed Get Pre-Qualified NOW! Mortgage Trends A VALUABLE LOAN OPTION FOR SELF-EMPLOYED BORROWERS If you are self-employed, it can be difficult for them to show enough income on your taxes to qualify for a mortgage. It can also be a hassle for you to gather the necessary income docs […]

Just What the Doctor Ordered

Just What the Doctor Ordered Get Pre-Qualified NOW! Mortgage Trends A home loan designed specifically for medical professionals Deciding to become a caregiver is commendable, but it’s often coupled with a significant student loan burden. The Doctor Loan is designed specifically for medical professionals who view medical school as an investment in a lifelong career. […]

What’s Ahead for Home Prices in 2023

What’s Ahead for Home Prices in 2023 Get Pre-Qualified NOW! Mortgage Trends Over the past year, home prices have been a widely debated topic. Some have said we’ll see a massive drop in prices and that this could be a repeat of 2008 – which hasn’t happened. Others have forecasted a real estate market that could […]

Choosing the Best Mortgage Options for Unique Circumstances

Choosing the Best Mortgage Options for Unique Circumstances Get Pre-Qualified NOW! Mortgage Trends Not all loan products are the same, nor are borrower situations. For first-time homebuyers, you’ll most likely hear about the most popular 30-year fixed-rate conventional loan, and there’s no arguing that it’s a great loan product for most buyers but not in […]

The Perks of Living in a Multigenerational Home

The Perks of Living in a Multigenerational Home Get Pre-Qualified NOW! Understanding Reverse Mortgages Mortgage Trends If you are facing a financial or health-related problem or simply going through a new phase in life, you may be thinking about sharing a home with close family or extended family members. Many people have decided that living […]

Common Myths About Reverse Mortgages

Common Myths About Reverse Mortgages Get Pre-Qualified NOW! Understanding Reverse Mortgages Mortgage Trends You’ve heard this before: It’s a scam. The bank takes your house. Don’t do it unless you’re desperate. However, here is the absolute truth about Reverse Mortgages. Home Equity Conversion Mortgages (HECM) were developed to provide some financial options for seniors over […]

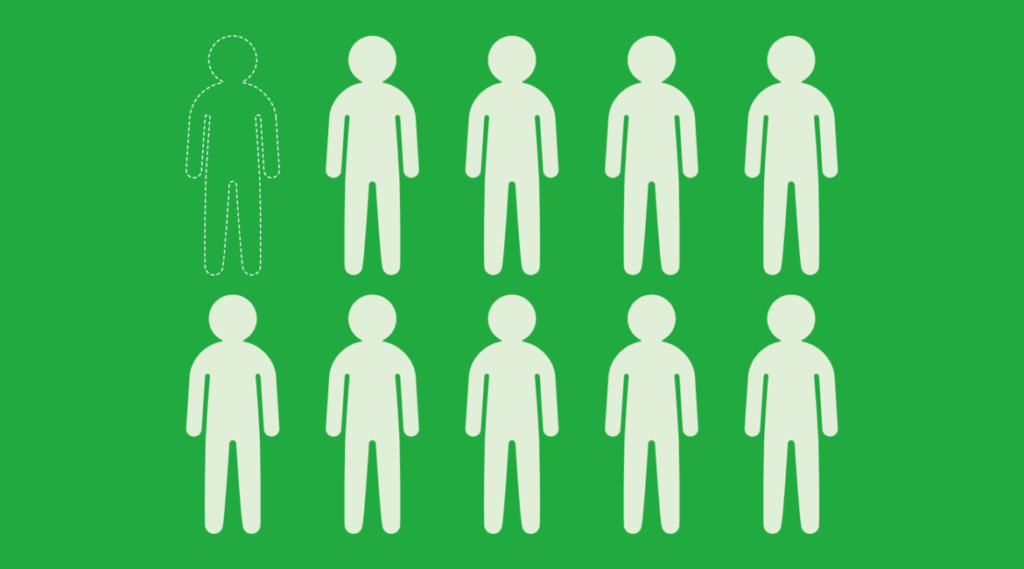

Go from Credit Invisible to Credit Seen

Invisible Credit Get Pre-Qualified NOW! How to Go From Credit Invisible to Credit Visible Mortgage Trends A person is “credit invisible” if they have no credit history or report at the three national credit bureaus (Experian, TransUnion, and Equifax). The Consumer Financial Protection Bureau estimates that one in 10 Americans have no credit history and […]